Section 179 – How it can help you

Janeen Waddell can assist office furniture dealers, designers, and furniture influences in presenting an unbelievable advantage to companies looking to redesign their office space this year, it’s called Section 179. This year, businesses are in a uniquely favorable position, as they can write off their entire furniture purchase, while also choosing to defer payments until 2023.

What does that mean? Let Use A Simple Example

Company A has a Net income of $100,000 as of 12/31/22

Company A purchases $100,000 of furniture by 12/31/22

Company A is in a 35% tax bracket

Company A writes off $100,000, leaving a taxable income of $0!

Company B has a Net income of $100,000 as of 12/31/22

Company B has no capital equipment or furniture purchase in 2022

Company B is in a 35% tax bracket

Company B will owe the IRS 35% of their taxable income, $35,000!

Which company do you want to be?

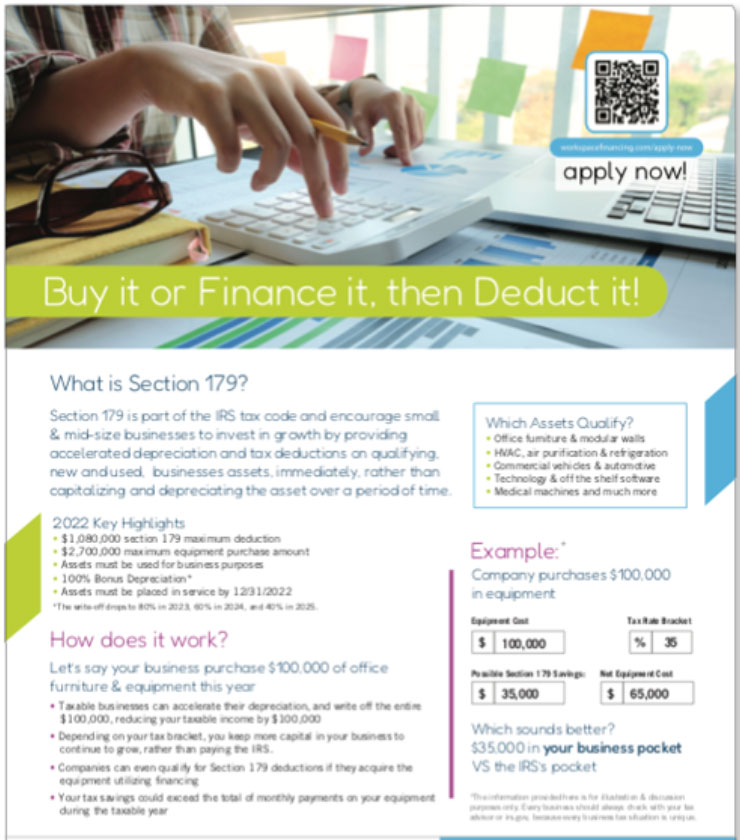

When ordered today, companies can lock in the best rates available before any additional rate increases come. Companies can deduct up to $1,080,000 of capital equipment purchases from their taxable income.

It’s all due to the 2022 Tax Incentive called Section 179, which was designed to assist and encourage small and midsize businesses’ growth by providing accelerated depreciation which helps lower taxable income. The tax deductions apply to both new and used assets from office furniture & modular walls, HVAC, technology, software, machinery, and more. Within the first year, these deductions allow for increased bottom line profits, better cash flow, and most importantly, a destination your employees can’t wait to get to.

Don’t wait if you want to lock in these rates, they’re rapidly becoming less favorable as the write-off drops to 80% in 2023, 60% in 2024, and 40% in 2025. We are not tax advisors, and neither are most of you and your clients, so the best thing you can do to bring value to your client is to say, “I’m not sure if you are aware, but in many cases, your entire purchase is 100% tax deductible, if you haven’t consulted your accountant about this project, you may want to, and see how this can impact your business.”

Let us highlight the benefits they can receive when financing. Call Janeen Waddell today at 609.206.4513 for more information or email [email protected] to get in touch!